We have designed web based Corporate DSA Loan Management Software for DSA which is extremely easy to use, user friendly where you can manage all your loan application files. Using our loan management system software you can easily send loan application forms to your banks & NBFCs.

Request Demo

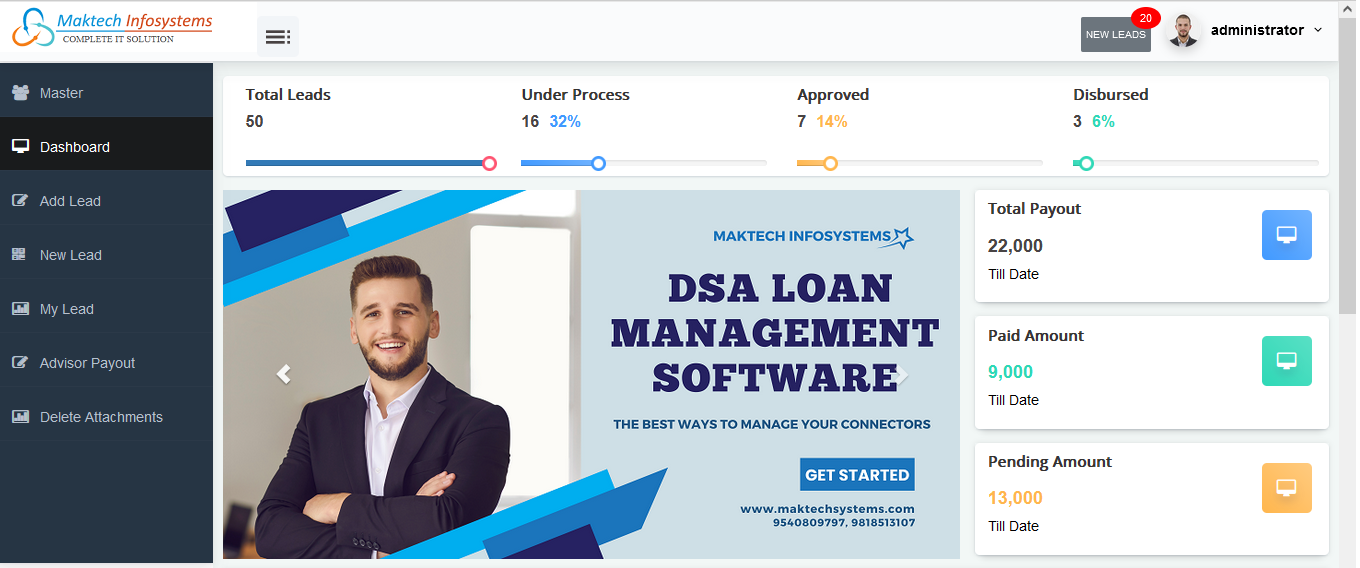

The admin dashboard is depicted in the image above. The advisor and employee dashboards are created in a similar manner. Your team will be able to view a consolidated report that shows the entire success of the loan management CRM right on the dashboard. You can display your company's logo and use it to market yourself on the dashboard above. You can include five photographs in your slider images that will assist you market yourself and periodically display the work you've done to promote yourself.

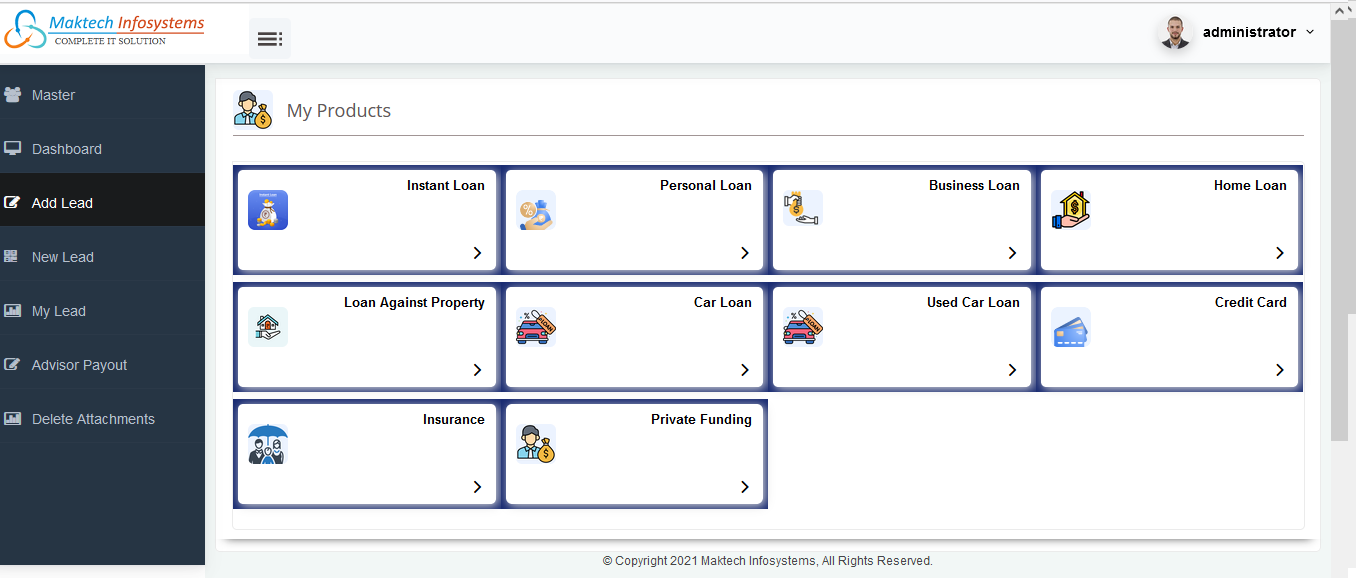

Here is a picture of my prodcuts. You can indicate the product you deal in from my products area.

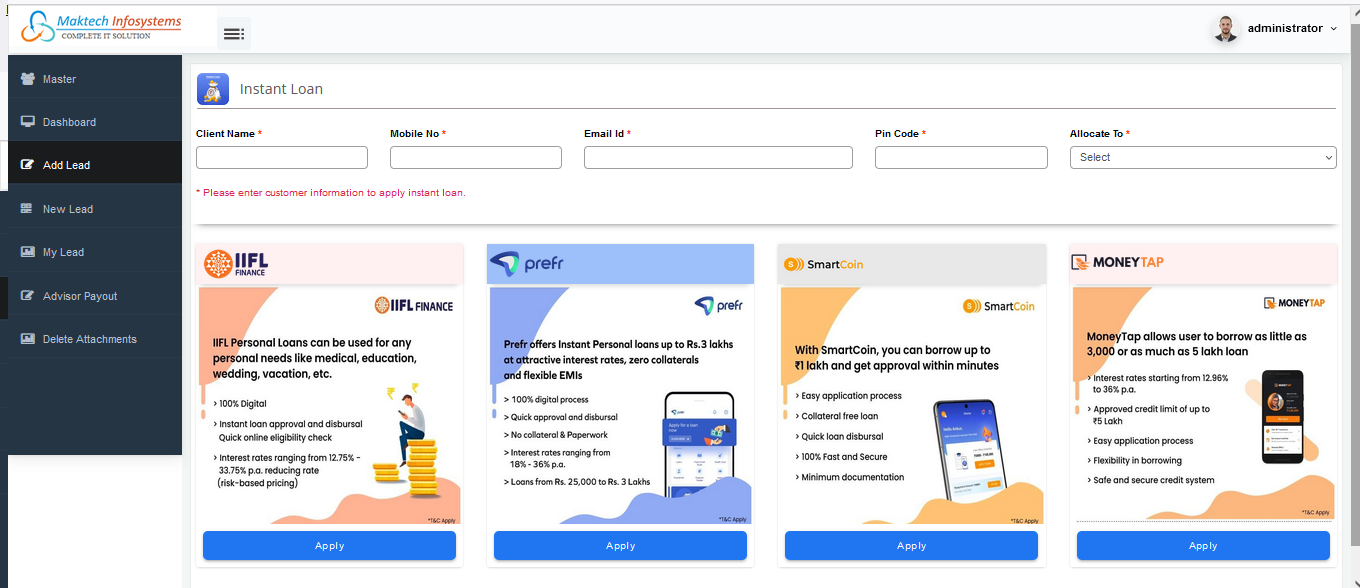

"Instant Loan" is represented by the image above. This is where your advisor may generate fast loan leads. You can enter all of your target api information here, and after entering the client data for the desired lender, your adviser will be instantly taken to that api link. You will also be able to provide comments on the immediate loan lead and payout that you have made. You won't have to manually transmit any lender links, which will save you time and effort when sending manual links to your various advisors.

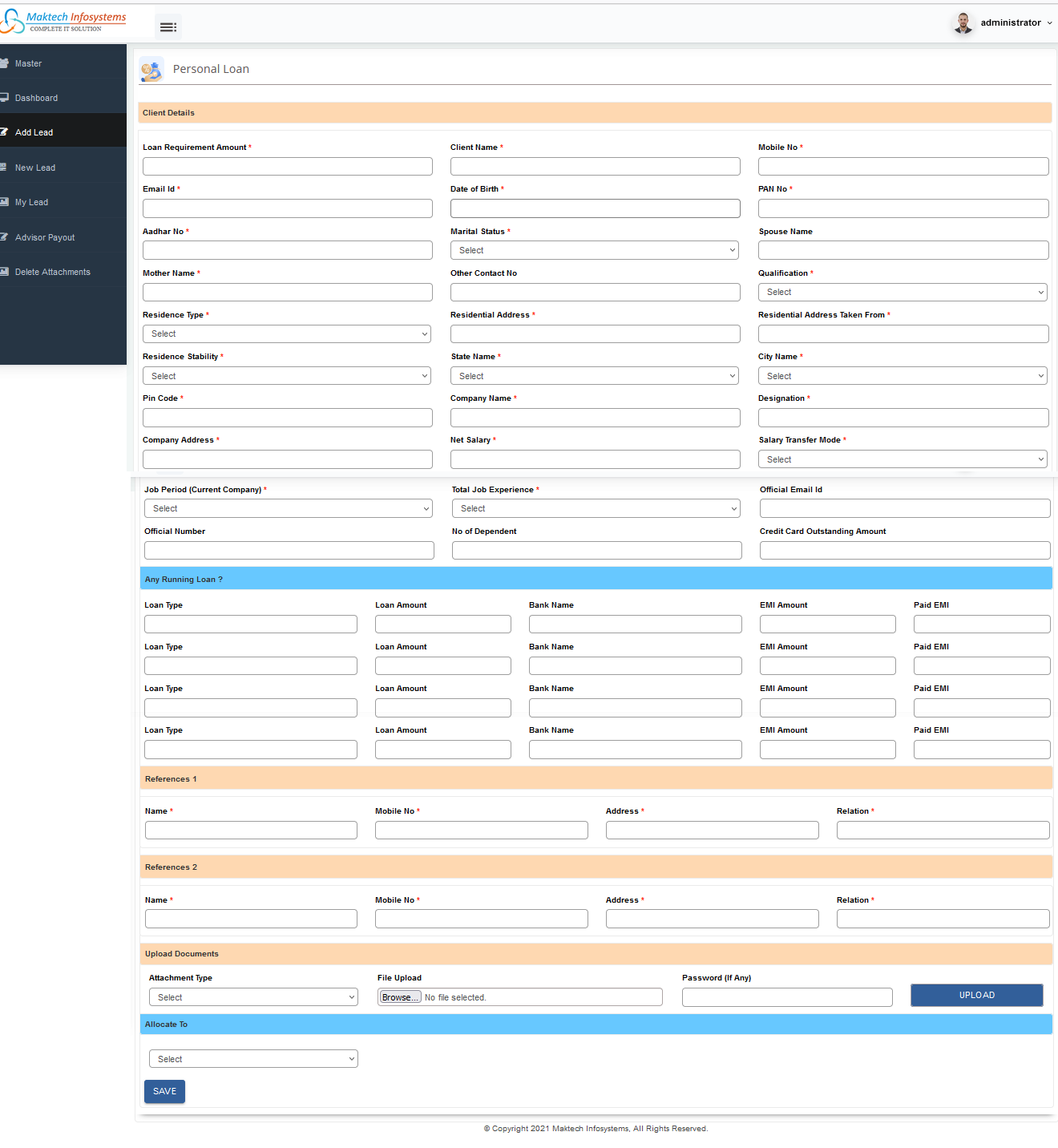

The above graphic is a representation of a "Personal Loan". This is the section where your adviser will enter all of the client details and attach the paperwork needed to apply for a personal loan.

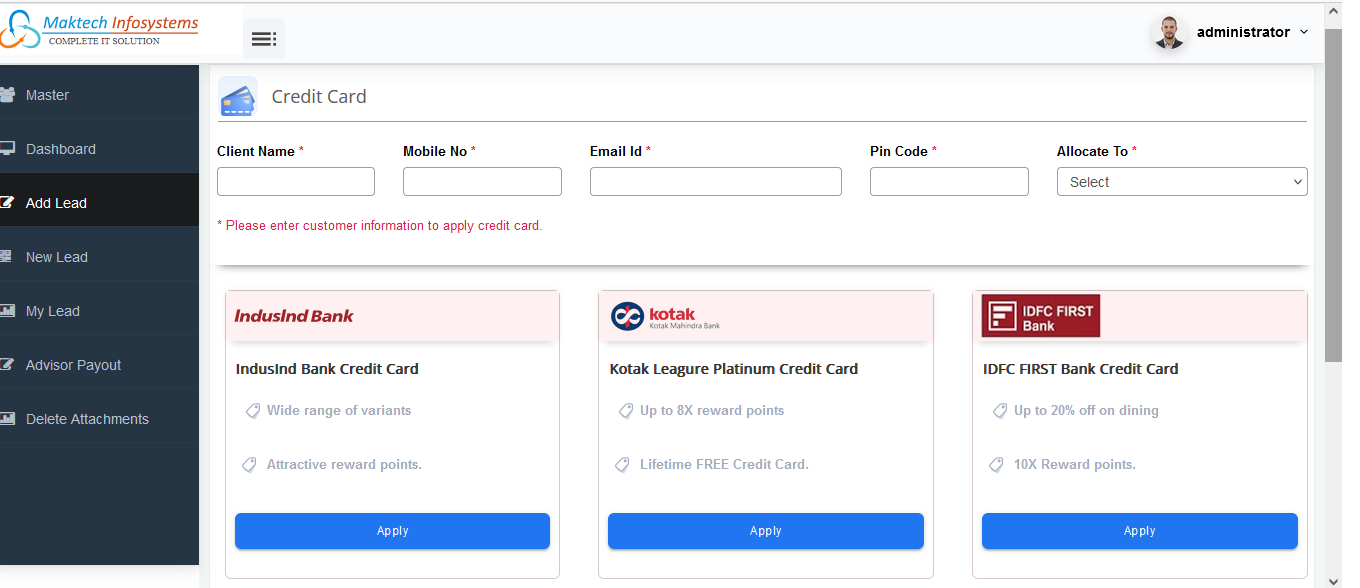

"Credit Card" is represented by the image above. This is where your advisor may generate fast credit card application. You can put all of your target api information here against credit card of different banks here, and after entering the client data for the desired lender, your adviser will be instantly taken to that bank api link. You will also be able to provide comments on the immediate credit card lead and payout that you have made. You won't have to manually transmit any lender links, which will save you time and effort when sending manual links to your various advisors.

Request Demo

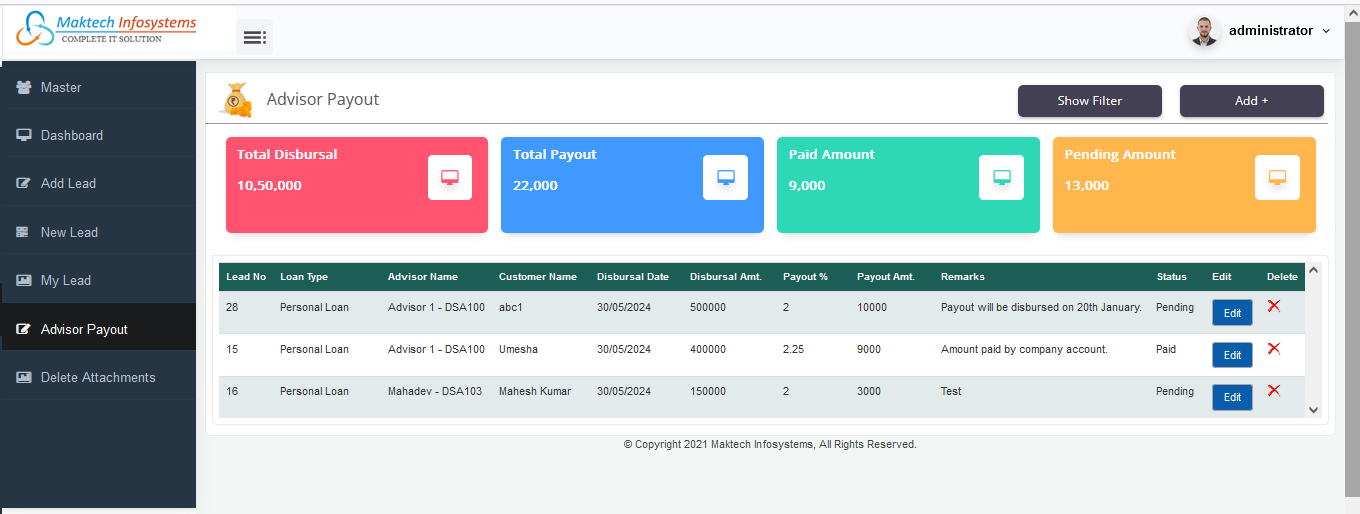

In Advisor Payout section you can raise payout agaist all disbursal loans. Once you will put payout information, your advisor will be able to see their payout status in their login.

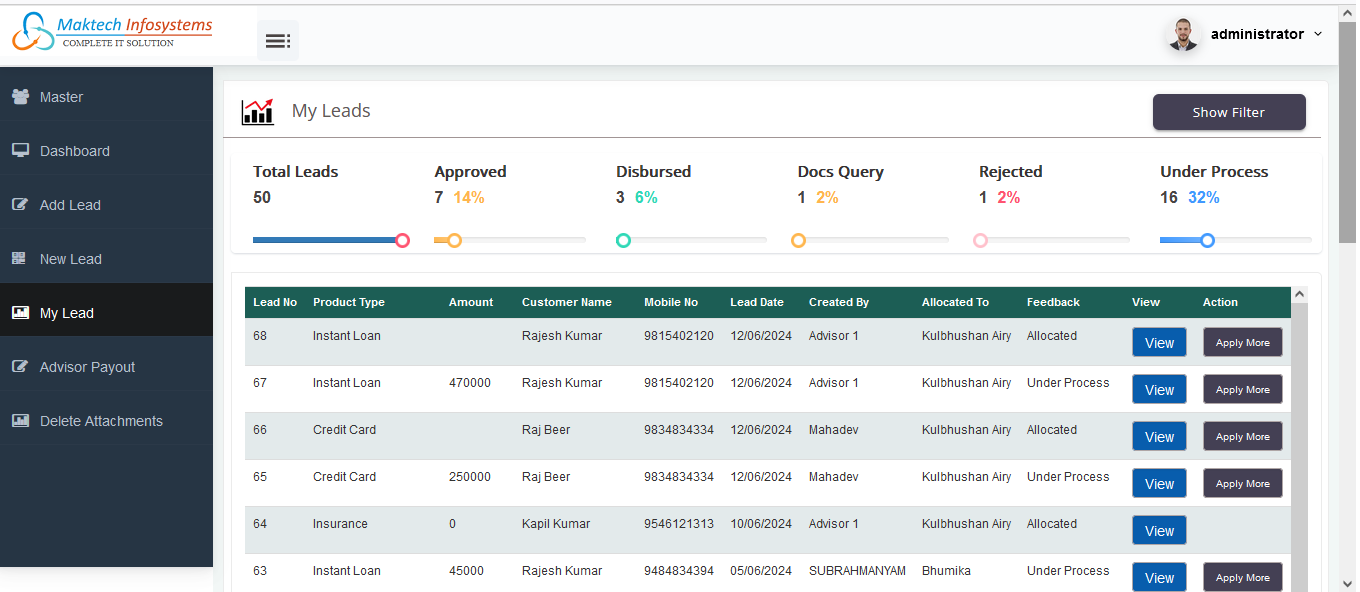

"My Leads" is represented by the image above. The above graphic is a representation of "My Leads". The "My Leads" feature is a crucial component of our loan management program. You can filter product categories and the application file's stage using this report. To improve productivity, you can download the lead status in Excel format. This will boost your productivity by enabling you to handle applications more quickly.

CRM Functionality Example – Suppose an advisor login personal loan application and this application will be received in your admin portal after that you will send this loan application to your team member and that team member will work on this personal loan application. If in given documents by advisors, pan card is not clear or banking is not updated then your team can update this query in this CRM and this update automatically sends to your loan advisors through your mail. After that advisor would be able to see what update comes from your team member for particular case and then he can upload pending documents and put feedback. That’s it.